” Reports of my death have been greatly exaggerated………”

… however, there will be more change in the automotive sector this decade than in the past 100 years!

We had the pleasure of working with Paul Butler and his team at the North East Automotive Alliance during 2018-19. The NEAA had the foresight to actively explore the changes in future automotive sector capability requirements arising from electrification, digitalisation and the acceleration of autonomous capability enabled by 5G.

Accelerating Pace of Change

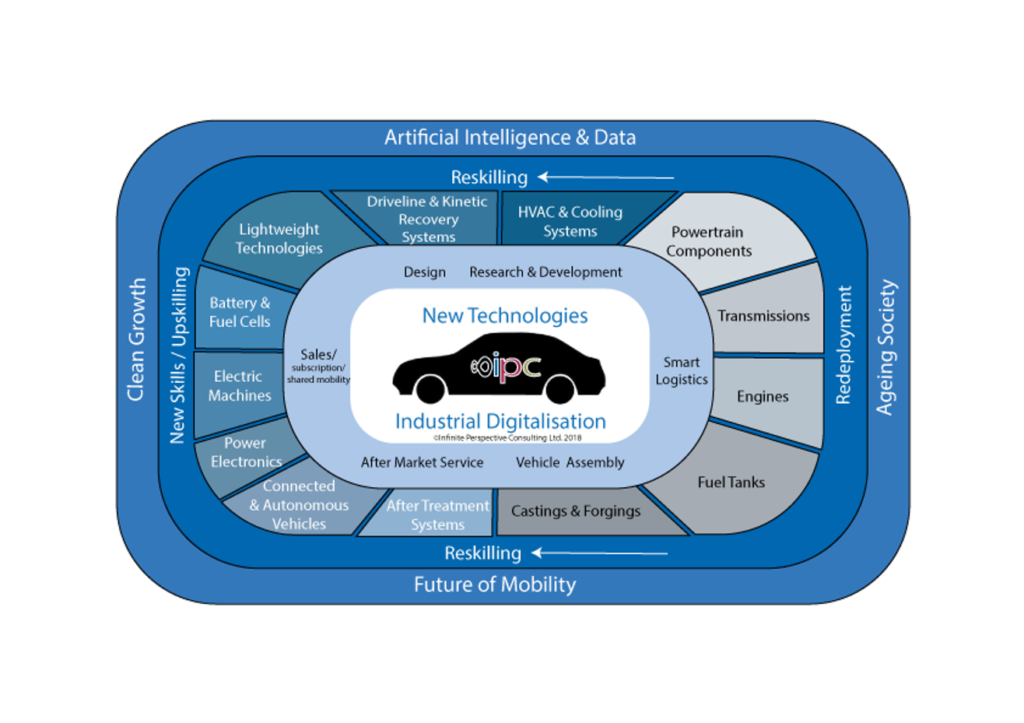

We drew the diagram below to try and illustrate the extent and magnitude of the impact of emerging technologies and industrial priorities for the sector workforce. All of of these factors are accelerating with the post Brexit and Covid-19 pandemic economic impetus. The mainstream automotive sector is starting to move at pace.

The legacy capability and skills are shown on the right of the diagram, requiring workforce redeployment activity or an exit plan. The new and emerging skill requirements are on the left and the supply of skills is key. In the middle, there are potential opportunities to re-purpose capability and re-skill, or exit. OEMs and first tier suppliers will have choices and these will be influenced by government policy and the availability of flexible skills.

Decisions are being made…

Things are changing fast and significant decisions are required at pace – Already in the news – Apple seek a manufacturing partner, JLR’s Re-Imagine strategy introduce a single BEV platform for each brand and a 2,000 employee reduction; Ford has teamed up with Google and Ford Europe has confirmed all BEV by 2030. Bridgend petrol engine plant has gone and the potential saviour, the INEOS Grenadier, has been tempted by a redundant Mercedes factory in France; GKN Driveline facility in Birmingham is announced to close; A short term reprieve for BMW Hams Hall, who will get the 6.75-litre twin turbo RR V12 and some V8 combustion engines to supply the BMW group, whilst Munich retools for fully electric. It’s good news that Nissan have confirmed its continued commitment to the UK, as well as increasing battery output in their adjacent factory.

The reality is the changes are so significant and for many they may also provide an opportunity for a clean break, not always possible with the softer transition from one model to another. An opportunity to repurpose, or lock the doors and walk away.

It’s Cross-Sector

Interestingly, the new skills are applicable across sectors and some capabilities already exists. Automotive core capabilities and sources of value will change and so will the skills that realise that value and partnerships and collaborations will become the norm. It is important that there is a plan for the re-alignment and reskilling of our UK automotive workforce for future needs and the emerging technologies, and that they are not left behind. History shows us that this will not just happen, and if local and central government are not proactive in providing attractive proposition for businesses, we are in danger of returning to the structural unemployment of the late 80’s, that devastates regions for decades.

Supportive UK and local policy.

Local government must take the initiative to encourage inward investment. Sunderland City Council is a past master at this, supporting the sector through the NEAA and promoting inward investment by getting the infrastructure in place for the sector, Recently Coventry City Council have indicated their intent to prime the region with an application for pre-emptive planning permission for a “Gigafactory” to make electric car batteries. The UK Government industrial and sector strategies are getting traction, for example DER – Driving the Electric Revolution is providing the innovation platform to get the UK supply chain in power electronics, machine and drives technologies to market faster. A cross sector approach that recognises the reskilling requirements and need for closer collaboration across the UK Universities and centres of expertise. Automotive electrification requires massive infrastructure charging requirements, but its only one piece of a complex puzzle, that involves a major rethink on power generation and distribution, building on the success of wind, involving the adoption of nuclear SMRs and the renaissance of hydrogen power.

It’s an Opportunity.

The changes in the sector have staggering implications for the UK automotive workforce at OEMs and in the broader supply chain. It also offers unprecedented opportunity for those that have the vision for the future great product, that the customer wants. The UK market was historically referred to as ‘treasure island’ by some car marketing departments, its a profitable market! Full electrification, removes historical barriers and will attract new entrants to the sector who will bring significant innovation in product and services. They will challenge a lot of the perceived wisdom of the established players and the paradigms that have been in place for decades. Interesting times, that we need to embrace and build from.

Recent Comments